TRENDING TAGS :

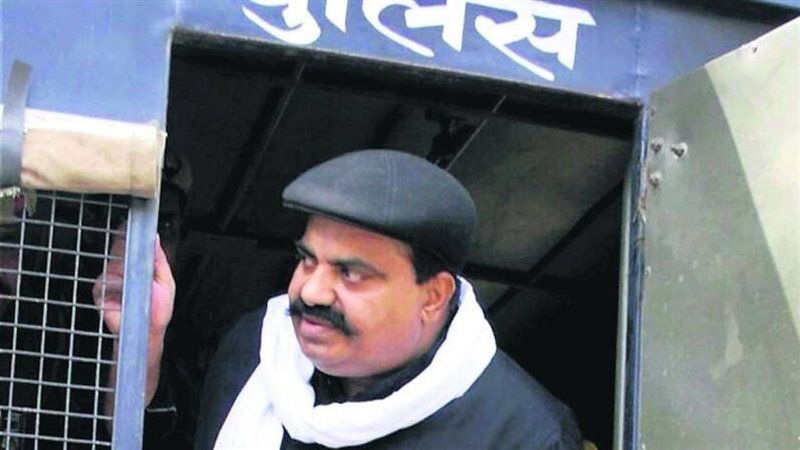

Atiq Ahmed’s Kin Nabbed in Rs 100 Crore GST Evasion Case

STF's arrest of Qamar Ahmed Kazmi, a relative of the late gangster-turned-politician Atiq Ahmed, reveals a complex scheme involving Rs 100 crore GST evasion through shell units.

Atiq Ahmed’s Kin Nabbed in Rs 100 Crore GST Evasion Case

Meerut unit of the Special Task Force (STF) has apprehended Qamar Ahmed Kazmi, a distant relative of the notorious gangster-turned-politician Atiq Ahmed. Kazmi's arrest late Thursday night unveils a convoluted scheme involving an alleged Goods and Services Tax (GST) evasion of Rs 100 crore through multiple shell units.

STF Superintendent of Police Brijesh Singh revealed that Kazmi, a relative of incarcerated Dr. Akhlaq Ahmed, was taken into custody after sustained interrogation and subsequently handed over to the Civil Lines police. Dr. Akhlaq Ahmed, Atiq Ahmed's brother-in-law, faced dismissal from his position as a government hospital doctor in Meerut after being arrested as a co-accused in the daylight murder of lawyer Umesh Pal and his police gunner in Prayagraj on February 24.

Kazmi, who owns nearly eight industrial units specializing in high-quality glasses, allegedly orchestrated the evasion through a network of shell units. These units, a total of several, served as conduits for routing money, exploiting the absence of GST on fledgling units for the first commercial transaction up to Rs 20 lakh.

STF sources divulged that a detailed account of the tax evasion has been shared with relevant state government departments. The probe is set to commence on Friday to estimate the actual extent of GST evasion and unearth the depth of this intricate financial web.

This isn't Kazmi's first encounter with legal scrutiny. The STF had previously raided his premises in Meerut Cantonment last year, seizing various documents and laptops. Following the raid, he sought refuge in Dubai. The authorities received intelligence that he had returned to his hotel in Meerut, leading to his arrest.

The arrest sheds light on the persisting challenges authorities face in tackling financial crimes involving intricate networks and shell entities. The STF's efforts to dismantle such operations underscore the ongoing battle against financial fraud and tax evasion, emphasizing the need for increased vigilance and stringent regulatory measures.

As the investigation unfolds, the case serves as a stark reminder of the evolving nature of criminal enterprises, necessitating a dynamic and adaptive approach to law enforcement and financial oversight.