TRENDING TAGS :

RBI keeps repo rate unchanged, shares tumble fearing inflationary pressure

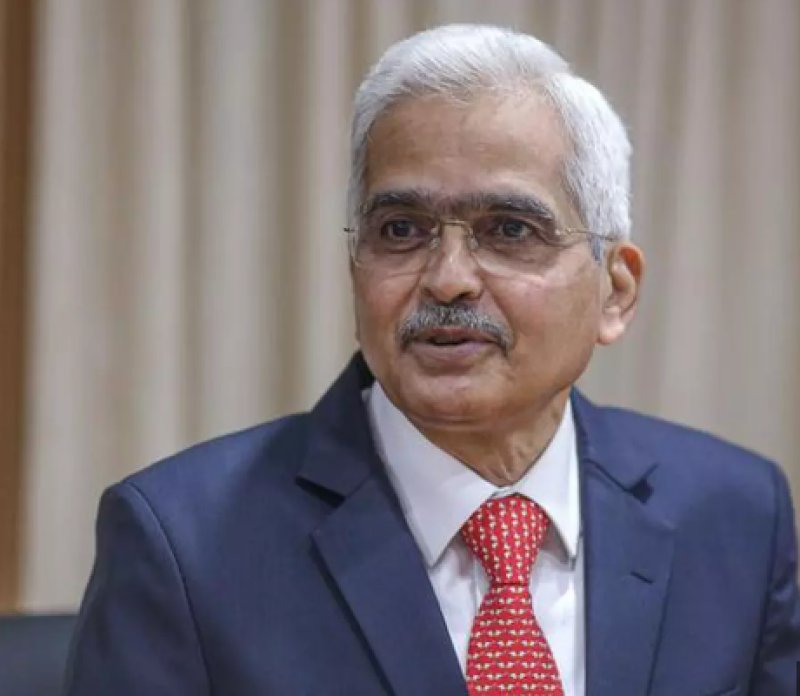

The central bank’s rate setting panel also decided by a majority of 5 out of 6 members to remain focused on “withdrawal of accommodation” to ensure that inflation progressively aligns with the target, while supporting growth, RBI Governor Shaktikanta Das said.

The Reserve Bank of India (RBI) on Thursday unanimously decided to keep policy repo rate unchanged at 6.5% for the third time in a row but revised retail inflation projection for the current fiscal to 5.4% from its earlier estimate of 5.1%.

The central bank’s rate setting panel also decided by a majority of 5 out of 6 members to remain focused on “withdrawal of accommodation” to ensure that inflation progressively aligns with the target, while supporting growth, RBI Governor Shaktikanta Das said.

As a result of the pause on repo rate, other key policy rates also remain unchanged. The standing deposit facility (SDF) rate remains unchanged at 6.25% and the marginal standing facility (MSF) rate and the Bank Rate at 6.75%.

In other words, the RBI's decision not to change the repo rate will mean that there would be no increase in the EMIs on home, car, and other loans.

“The month of July has witnessed accentuation of food inflation, primarily on account of vegetables. The spike in tomato prices and further increase in prices of cereals and pulses have contributed to this,” RBI Governor said.

“We have made good progress in sustaining India’s growth momentum. While inflation has moderated, the job is still not done,” RBI Governor said.

“Inflationary risks persist amidst volatile international food and energy prices, lingering geopolitical tensions and weather related uncertainties,” he added.

Indian shares declined on Thursday, led by financials, after the Reserve Bank of India (RBI) held its key rates steady for the third consecutive time as expected while raising its inflation forecast.

The Nifty 50 index was down 0.47% at 19,539.15, while the S&P BSE Sensex fell 0.52% to 65,655.19. Both the indexes lost more than 0.7% each following the announcement after falling 0.3% each ahead of the decision.