TRENDING TAGS :

GST council meeting may fail again to resolve differences

GST council meeting may fail again to resolve differences

Lucknow: Going by the statements of finance ministers of two non-BJP states of West Bengal and Kerala, the introduction of Goods and Services tax ( GST) from the first of the next financial year is highly unlikely. Of the two , finance minister of West Bengal, Amit Mitra, has been more categorical on the issue.

" There are 15 clauses on which there are differences. All these are unlikely to be resolved before the start of the next financial year", he has told a national daily".

He has also claimed that if all the central government's proposals are accepted " inspector's raj will be back".

As this statement has come on the eve of the ninth meeting of the GST council scheduled to be held on Monday (today) the outcome of the meeting can be easily guessed. Differences have persisted although the council has held eight meetings in past two months.

The two states and some others including Bihar are demanding higher compensation in view of the estimated higher loss of revenue due to demonetisation. The other main clause of disagreement is control over the assesses.

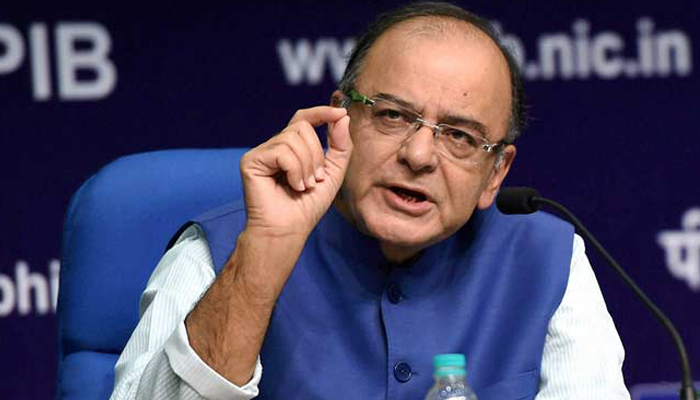

While other states may fall in line, these two which are totally opposed to the BJP government at the Centre are likely to support it either in this case or some others. Union finance minister Arun Jaitley is not unaware aware of the situation but is not ready to leave it at that. He is trying hard to meet the deadline which is unlikely to be met.

In any case it has to be implemented by September middle as per the new notification issued after the adoption of GST bill by the two houses of parliament. In view of this notification the old tax regime will cease to exist after July next.

The government has not yet made it clear what it proposes to do if the GST council fails to finalise the draft for new legislation with regard to the GST before September .Besides parliament it has to be adopted by fifty cent of total 29 states in the country before the new tax regime begins.

Next Story